Your micro-investment platform partner

Don’t Waste Your Chicken Feed,

Start Investing Your Spare Change Today!

Investors: Take control of your finances and start effectively building your

nest egg.

Financial intermediaries: Pitch to an untapped market and diversify your

financial products

Market operators: Cater for tomorrow’s investors today and build an investment culture.

Solutions for Financial Market Participants

Investors

Take control of your finances and start effectively building your nest egg.

Financial Intermediaries

Pitch to an untapped market and diversify your financial products.

Market Operators

Cater for tomorrow’s investors today and build an investment culture.

Benefits of Chickenfeed.investments for investors

1

Ease of Entry

-

Start investing with just a few dollars—ideal for beginners or those with limited

income.

- No need to wait until you have saved large sums.

2

Accessibility to Financial Products

-

Enables access to stocks, ETFs and bonds that would otherwise be unaffordable

(e.g. fractional shares).

3

Encourages Financial Discipline

- Create consistent saving and investing habits.

- Builds a long-term investing mindset.

4

Diversification Made Easy

- Able to invest into basket of ~/Assets with dedicated financial products.

-

Fractional investing allows for portfolio diversification even with small amounts.

5

Reduced Risk Exposure

-

Lower financial commitment reduces the risk of loss for new or cautious investors.

- Learn by doing with real skin in the game but limited downside.

6

Financial Education & Confidence

-

Real-time experience helps investors learn about markets, volatility, and returns.

- Increases confidence to eventually invest larger amounts.

Benefits of Chickenfeed.investments for financial intermediaries

1

Broader Investor Base

-

Tap into previously underserved or untapped markets – young investors, low-income

earners.

2

Recurring & Predictable Inflows

-

Recurring contributions, which improve cash flow predictability.

3

Increased AUM Over Time

-

While individual contributions are small, aggregate volumes can be significant with

scale.

- A larger AUM leads to higher management fees, even if marginal per investor.

4

Diversification of Investor Risk

- A broader base of retail investors can stabilise fund flows.

- Reduces dependence on large institutional investors who may move large sums quickly.

5

Brand Trust & Loyalty

- Building relationships with retail investors early fosters long-term loyalty.

-

Microinvestors are more likely to scale up investments with the same financial

intermediary.

6

Distribution Innovation

- New tech-driven channels for financial product distribution.

- Reduces dependence on traditional financial advisors or legacy platforms.

Benefits of Chickenfeed.investments for market operators

1

Increased Market Participation

-

Broadens investor base by allowing low-income and young individuals to invest small

amounts.

- Encourages first-time investors, particularly Millennials and Gen Z.

2

Improved Market Liquidity

-

Small, frequent trades increase trading volume, enhancing liquidity across listed

equities, especially for blue-chip stocks.

- Helps maintain a more dynamic and active market environment.

3

Boost in Exchange Revenues

-

More transactions, even if small, lead to higher cumulative trading fees and

commissions.

-

Opportunity to partner with fintech platforms offering microinvestment services,

expanding fee-sharing models.

4

Enhanced Financial Inclusion

- Contributes to democratising access to capital markets.

- Aligns with ESG and regulatory goals promoting inclusive finance.

5

Support for Smaller Public Companies

-

Microinvestors may help drive demand for less-liquid, mid-cap, and small-cap stocks,

benefiting broader listings.

- Promotes a more equitable capital market beyond large institutional flows.

6

Encouragement of Long-Term Investment Culture

- Promote recurring contributions, fostering long-term investor habits.

- Reduces short-term speculation, contributing to market stability.

How Chickenfeed.investments Works in 3 Easy Steps

Getting started with Chickenfeed.investments is simple and takes just minutes for

investors to get onboarded

Sign Up & Verify

Create your account and complete the identity verification (KYC) process securely

Set your investment preferences and build your investment balance

Choose your investment strategy and investment settings

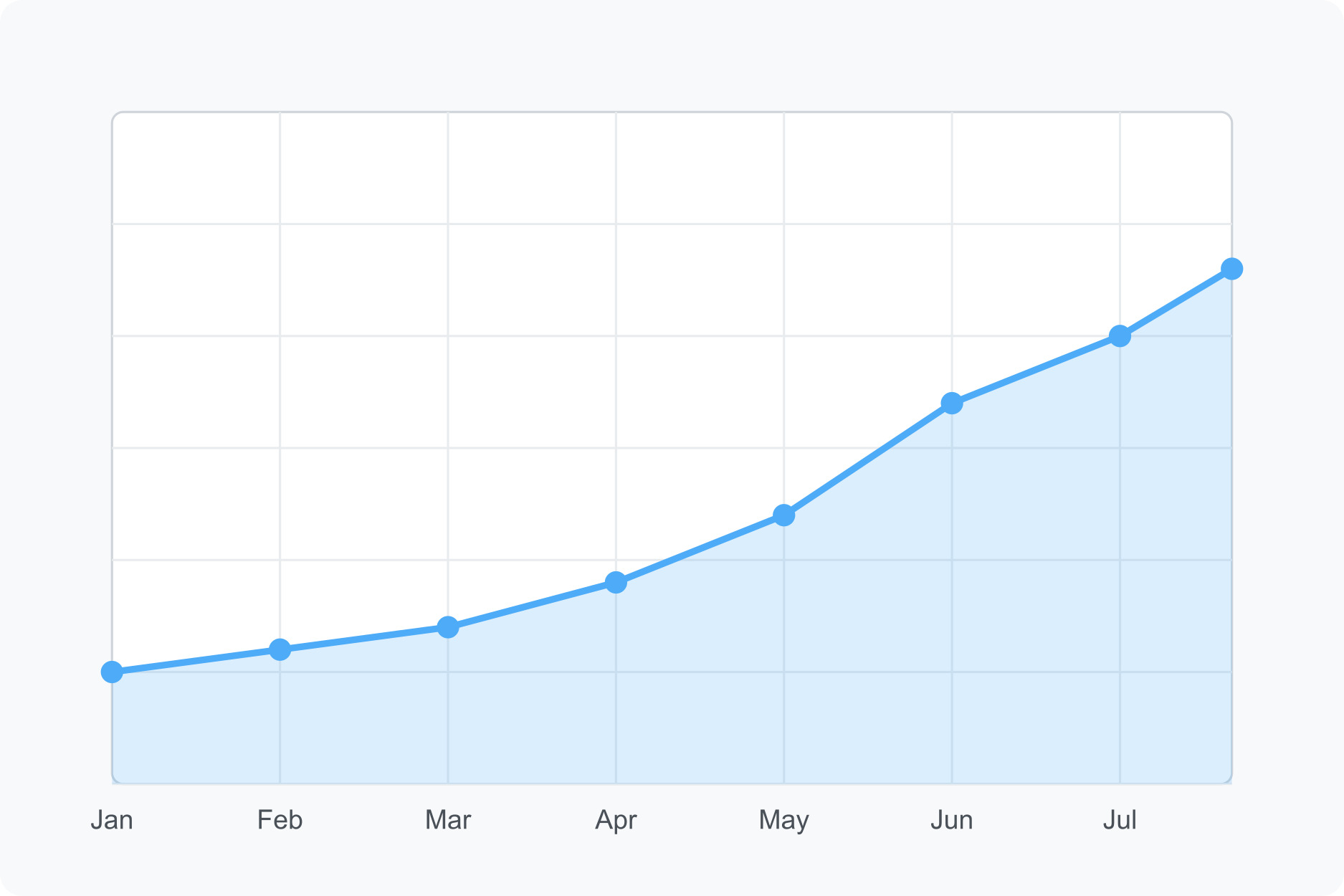

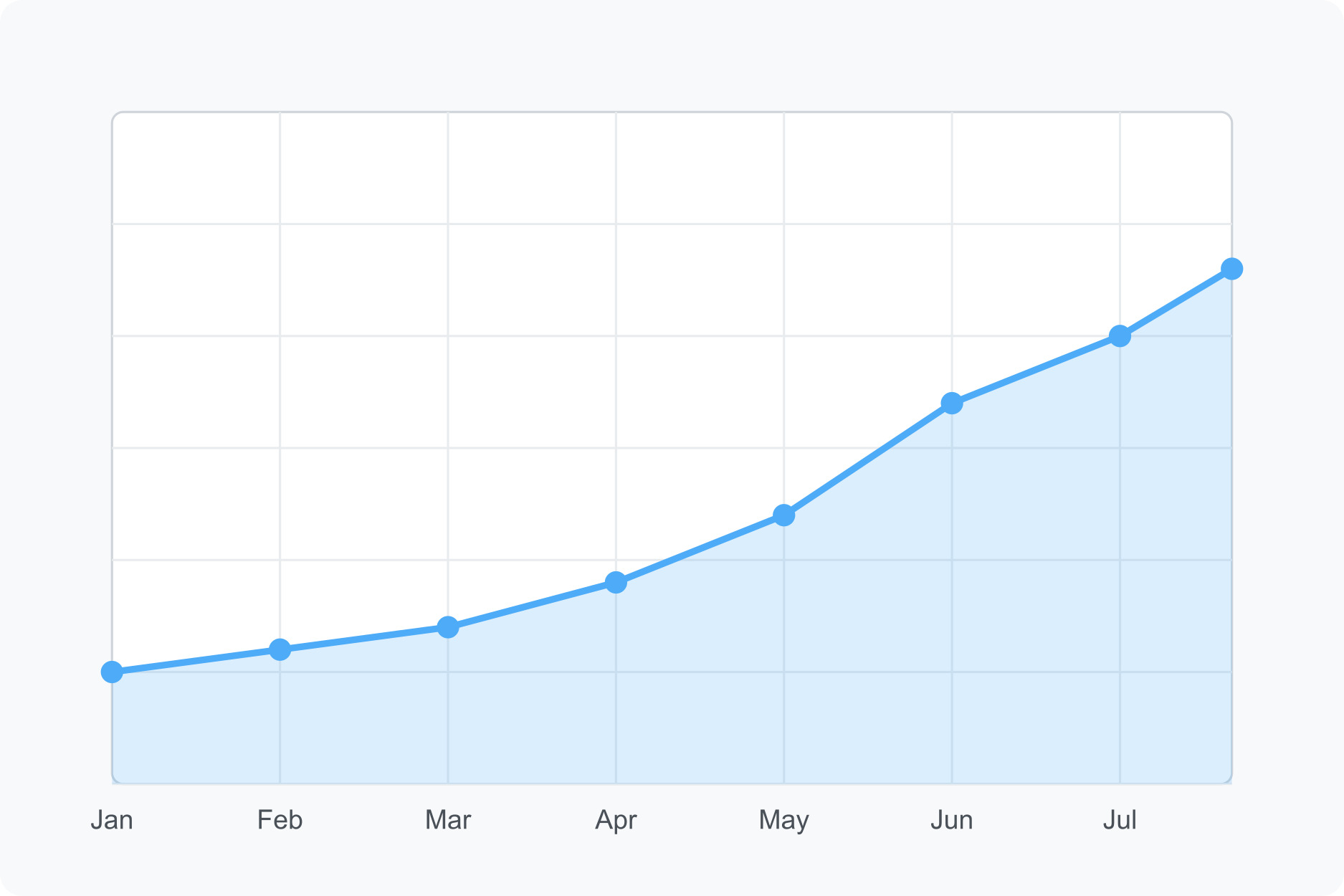

Watch Your Investments Grow

Track your portfolio performance and watch your investments grow

Invest. Earn. Grow Together.

Leverage off the new tech-driven distribution channels to unlock an untapped market and

lower the entry barrier for investors to start their wealth building journey.